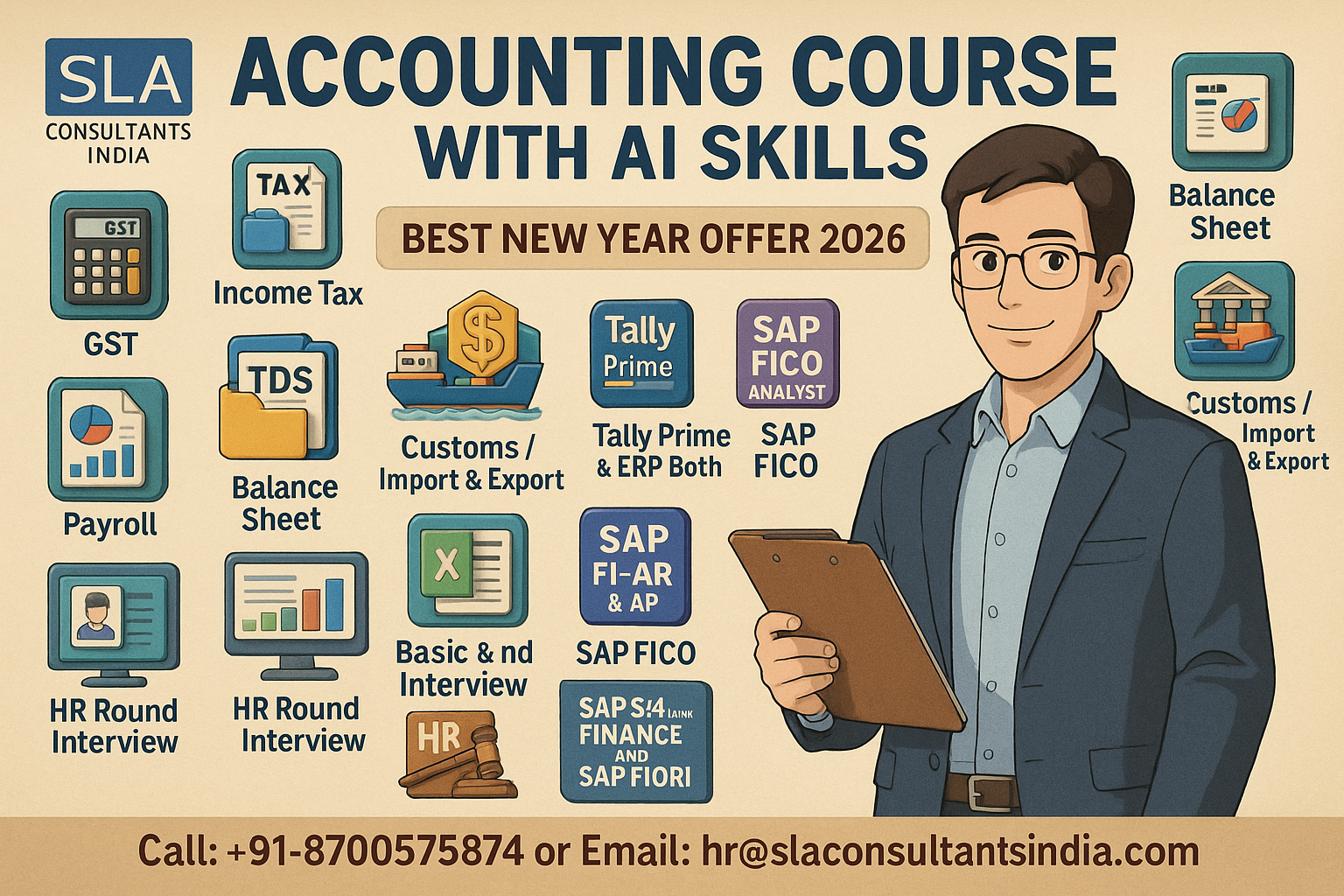

SLA Consultants India stands out for its Online Accounting Course serving Delhi, Noida, and Ghaziabad, with 100% job placement and salaries up to 4.5 LPA. The program delivers expert GST compliance, SAP FICO training, and certification, enhanced by the “New Year Offer 2026” to fast-track careers in finance and taxation for Delhi NCR professionals like you in Gurugram.

Robust Course Content

This 80-200 hour hybrid online/offline training, guided by 4-6 CA/FCA instructors with 10+ years of experience, features 9-20 modules: Advanced GST Practitioner (by CA), Income Tax/TDS (ITR 1-7), Balance Sheet Finalization & Banking, Customs/Import-Export, Tally Prime/ERP9 (GST/TDS/Payroll), Advanced Excel/MIS Reporting, SAP FICO (FI-AR/AP, CO, Integration, Reports), SAP HANA/S/4HANA, and HR Payroll/Compliance. Real-time e-filing, client projects, simulations, handouts, and module-based flexibility align with your accounting, GST, and SAP interests, incorporating AI tools for 2026 relevance.

New Year 2026 Specials

The promotion offers dual GST/SAP certifications, free SAP HANA modules, lifetime support, fee discounts, and AI upgrades at no added cost. Web/desktop instructor-led sessions fit busy Gurugram/Delhi NCR schedules, providing practical e-accounting and taxation skills for freshers and upskillers seeking job-oriented programs.

Placement Success

Support begins after 70% completion, including resume optimization, mock interviews, Accounting Course in Delhi HR training, and guaranteed interviews at Genpact, IDBI, Kodak, HDFC, Deloitte, and MNCs. Alumni secure 3-6 month roles at 3-6.8 LPA in fiscal sectors, driven by strong networks and proven SAP/GST outcomes.

SLA Consultants Online Accounting Course in Delhi, 100% Job, Salary upto 4.5 LPA, GST, SAP FICO Training Certification, Delhi, Noida, Ghaziabad, “New Year Offer 2026” details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/accounts-taxation-training-course.aspx

https://slaconsultantsnoida.in/courses/best-accounting-taxation-practical-training-institute/

E-Accounting & Taxation/ BAT Master Program Training Course Modules

Module-1- Advanced Goods & Services Tax Practitioner Course by CA– (Indirect Tax)

Module-2- Advanced Income Tax Course & Direct Tax Code 2025 by CA– (Direct Tax)

Module-3- Advanced TDS Practical Course Certification Course by CA– (Direct Tax)

Module-4- Balance Sheet Finalization in Excel

Module-5- Banking & Finance Practical Course

Module-6- Customs / Import & Export Procedures- by CA

Module-7- Tally Prime & ERP Both General Accounting & Bookkeeping

Module-8- Advanced Tally Prime & ERP Both TDS, Payroll & GST

Module-9- Financial Reporting – Basic Excel

Module-10- Financial Reporting – Advanced Excel & MIS

Free with Module 1 to 10

Module-11- HR Round Interview

Module-12- SAP FICO Analyst

Module-13- SAP FI-AR & AP

Module-14- SAP Control – SAP CO

Module-15- SAP INTEGRATION BETWEEN FI-SD & FI – MM

Module-16- SAP FICO – REPORTS

Module-17- HR Statutory Compliance

Module-18- Advanced HR Payroll Course in Excel

Module-19- SAP HANA VERSION 2020 (SAP S/4 HANAFINANCE AND SAP FIORI)

Module-20- RoC Fee is INR 24000

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/

Overview

- Tuition Type: Others

Leave feedback about this